TaxBuddy is an online platform available on mobile app, web browser as well as WhatsApp, which enables our Subscribers to file tax returns (ITR and GST) with the assistance of our tax experts.

Our Company provides the following services through TaxBuddy:

Assisted ITR and GST Filing

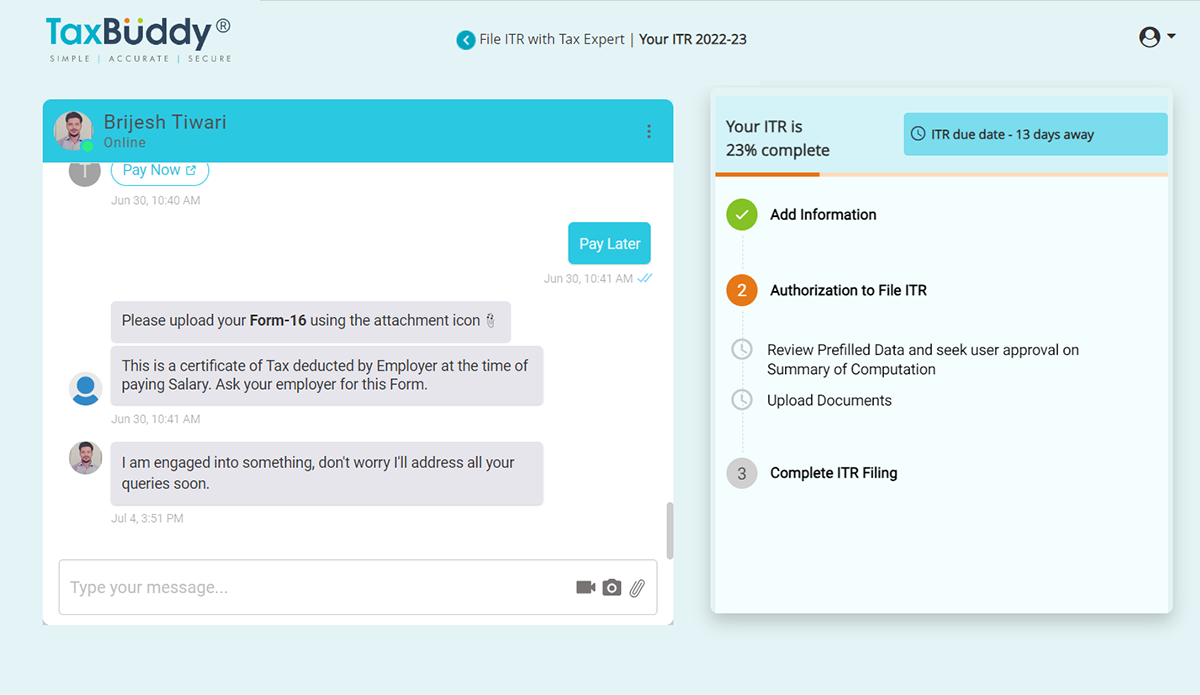

We assist our Subscribers with filing of income tax (ITR) and GST returns under guidance of Tax Experts. Our platform allows Subscribers to file ITR under various categories, namely - ITR 1 (Sahaj), ITR 2, ITR 3, ITR 4, ITR 5, [ITR 6], and [ITR 7]. For GST returns, a User has an option to subscribe our plans on quarterly as well as annual basis. Subscribers can seek guidance of Tax Experts in filing of original returns, revised returns, belated returns or rectification of tax returns. Subscribers have access to multiple communications channels like support numbers, web chat, email, WhatsApp, through which Tax Experts provide just-in-time tax advice.

Subscribers can seek guidance of Tax Experts in filing of original returns, revised returns, belated returns or rectification of tax returns. Subscribers have access to multiple communications channels like support numbers, web chat, email, WhatsApp, through which Tax Experts provide just-in-time tax advice.

Tax Planning

The tax planner is a do it yourself (DIY) tool which guides Users for effective tax planning. Income Tax Act comprises of multiple sections and rules which need to be analysed, customized, and applied to individual User based on user’s income and planned tax-saving investment. This ensures, Users make the right selection of tax saving investments and minimize taxes, while staying within the scope of the law and regulations. The inbuilt intelligence in tax planner aims to minimise tax outflow and ensure maximum wealth creation for the User.

The User can download PDF report for offline reference. Additionally, the tax planner also provide comparison of tax outflow based on old and new tax regime. In case, User needs any additional details or has queries, they can reach out to the tax advisor via mobile or web application or WhatsApp.

Tax Advisory

TaxBuddy Users are supported by tax advisors for round the year tax advisory to address any additional tax related queries. The Users can simply type the query in chat window to get response or use ‘Schedule a call’ feature to schedule a call with Tax Experts to address the specific queries related to ITR filing, GST, tax planning or tax notices.

The Users can also refer to the comprehensive FAQ section available on mobile and web application to address the frequently asked queries raised by Users.

Income Tax Notices Management

Based upon the sampling criteria adopted by the Income Tax Department, Income Tax Notices are issued to tax filers upon non-compliance with tax laws. The reasons can be error in filing original return, non or short payment of tax, non-filing or late filing of return etc. Tax Experts (which are essentially the Tax Experts) helps Users and Subscribers to understand, ascertain and validate the issue raised by department and respond to the notices properly.

TaxBuddy has developed AI based tools which are used internally in back office, to identify reasons for IT notices automatically and helps the Tax Experts to validate and prepare response to the Income Tax Department with quicker turnaround. The Tax Experts assist Users and Subscribers throughout the notice life cycle until the issue is resolved and closed.

www.taxbuddy.com

- Services Offered:

Assisted ITR and GST Filing,

Tax Planning,

Tax Advisory,

Income Tax Notices Management